How Data Providers Are Reacting to the Surge in Demand for ESG Data/Analytics

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

How Data Providers Are Reacting to the Surge in Demand for ESG Data/Analytics

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

How Data Providers Are Reacting to the Surge in Demand for ESG Data/Analytics

The increased interest and attention afforded to ESG in the last two years has led to a dramatic increase in demand for ESG data/analytics across the industry, altering the strategy of data providers.

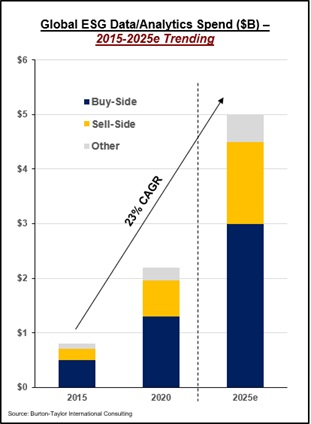

This demand for ESG data/analytics is being driven by the buy-side as it attempts to quench the thirst both institutional and retail investors have for sustainable investing. As the ‘emerging affluent’ increase their wealth and are likely to seek out advisors and wealth managers that offer ESG investing options, the buy-side is expected to remain the dominant segment in terms of industry spend on ESG data/analytics. In Burton-Taylor’s recent report, The Increasing Role of ESG in Capital Markets: How Data Providers are Reacting to the Change, global spend for ESG data/analytics for 2020 is estimated to be $2.2 billion with that figure expected to reach $5 billion in 2025. ESG data/analytics is one of the fastest growing segments of the broader financial market data/analysis space, which Burton-Taylor reports totaled $33 billion in 2020, with a 5-year CAGR of 4.6%.

Data providers are newly focused on products that help evaluate businesses by their adherence to ESG issues. Though many providers have had some level of ESG data for years, in response to industry demand and interest in sustainable investing, their respective ESG-related data products and solutions have become much more prominent on websites and in existing platforms, such as terminals and desktops. Unlike most areas of the business, many in the industry require increased levels of education on ESG – like how to interpret ESG data, how to incorporate it into their existing processes, and how to speak to clients and customers about it. As a result, providers are increasing the level of content available on ESG by building knowledge centers full of timely industry insights, reports, and news items.

Over the past several years, data providers have been active in building out their respective ESG offerings, both organically and via acquisition. Strategic partnership and M&A activity have allowed providers to enhance their ESG capabilities and is expected to continue. Partnerships and acquisitions that don’t specifically relate to ESG can still improve a provider’s position in the space. By increasing the footprint in target segments like wealth management or the private markets, or in a region, like Europe or Asia, a provider would be in a more advantageous position as it relates to ESG down the road.

The quantity of company reported ESG data available for providers to source is improving as pressure mounts for companies to publicly disclose the information. Although this benefits providers because they can expand their coverage, sourcing and aggregating this data in a standard format is a cumbersome process. Due to the lack of mandatory disclosure requirements and standard reporting frameworks, company reported ESG data is often incomplete and inconsistent, causing data providers to require large research and analyst teams to comb through a variety of publicly available sources to collect then standardize the data. Regulation around mandatory disclosure requirements and a standard method of reporting ESG metrics will be a welcome sight for providers and crucial for the evolution of the ESG data/analytics industry.

As demand continues to rise across the industry, providers will actively expand their ESG divisions, continue building out their data coverage, and work to smooth out the data process. Progress will also be made on the development of predictive and real-time monitoring solutions that utilize advanced technology like AI and ML, allowing investors deeper insight into the ESG performance of a company or sector. Moving forward, providers will work to deepen their presence in areas where the demand for ESG data is already high and expected to increase unabated in the short and long-term, such as investment management, wealth, and the private markets.

Adler Smith is an analyst with Burton-Taylor International Consulting. Visit the research section of our newly redesigned website at https://tpicap.com/burtontaylor/ to see Burton-Taylor’s latest research.