Changing Organizational Landscapes Prioritizing Data Sales Drive Inter-Dealer Broker Market Data Growth

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Changing Organizational Landscapes Prioritizing Data Sales Drive Inter-Dealer Broker Market Data Growth

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Changing Organizational Landscapes Prioritizing Data Sales Drive Inter-Dealer Broker Market Data Growth

The inter-dealer broking industry has been in a near-constant state of flux following the credit crisis of 2008, where macroeconomic factors challenged the historic revenue models of the IDBs. In response, IDBs were forced to look to newer revenue streams, thus placing a new emphasis on IDB data programs.

The position of the inter-dealer broker in the overarching market structure has seen a drastic change in recent years, fueled by regulatory changes and technological advancements challenging the way trading had been done since the inception of OTC markets. IDBs have been forced to display agility in response to these macro trends, with firms looking to bolster revenue through consolidation as well as through leveraging trade data to bolster volatile trade-based revenues.

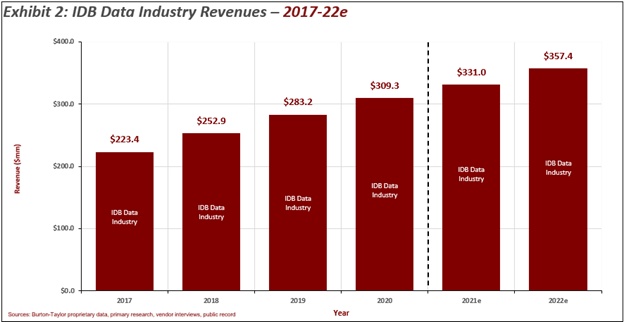

IDB Data programs aren’t exactly new to the market, though they’re receiving far more attention from organizations in recent years. Formerly, IDB data teams trafficked exclusively in the sale of raw trade data that third party vendors would aggregate, repack, and sell. Following the precedent set by large exchange data operations, IDBs have begun installing their own data scientists and packing data directly for sale to customers. This has generated massive growth in the space, leading to a 9.5% four-year CAGR for total IDB market data spend and growing revenues to a record $309.3 million in 2020.

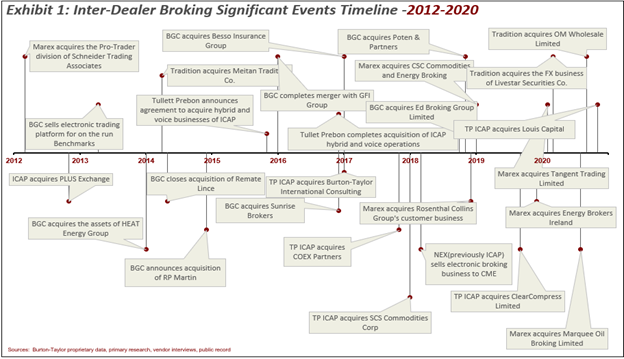

Consolidation has gripped the industry post ’08, as larger IDBs looked to maintain their position in a shrinking market. Nearly every provider still operating today engaged in aggressive M&A activity, most notably the Tullett Prebon-ICAP acquisition and the BGC Partners-GFI Group merger. Many smaller deals shored up revenue streams, while simultaneously granting IDBs access to more boutique products trafficked by smaller brokers. This M&A surge had massive implications on data teams, giving firms access to a wider variety of data sets and combining multiple smaller data teams to form more robust programs.

IDBs have largely embraced the data movement in recent years, headlined by organizational rebranding efforts from the top two IDB data providers, TP ICAP and BGC Partners. In April 2021, TP ICAP rebranded its D&A team to Parameta Solutions separating from the namesake of the associated IDB, similar to BGC’s FenicsMD division.

Looking ahead, it’s unlikely we’ll see a contraction in IDB data revenue streams in the foreseeable future, and growth is likely to increase in pace in coming years. Many IDBs are just beginning to prioritize data sales, and as more firms expand data programs revenues are likely to maintain high single digit growth in coming years. As the role of the IDB changes in the modern financial system, data revenue streams will likely play an ever-growing role in the business models of inter-dealer brokers.

Sean Eskildsen is an analyst with Burton-Taylor International Consulting. Visit our newly redesigned website at https://burton-taylor.com/ and see Burton-Taylor’s 2021 benchmark report on the IDB data industry at https://burton-taylor.com/idb-market-data-industry-2021/