Index Providers Earn Record Revenues as Investors’ Quench Thirst for Thematic Investments

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Index Providers Earn Record Revenues as Investors’ Quench Thirst for Thematic Investments

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Index Providers Earn Record Revenues as Investors’ Quench Thirst for Thematic Investments

The index industry expanded 9.7% in 2020 bringing total revenues to $4.08 billion, as record AUM in ETPs due to a sharp uptick in trading volumes amid the COVID-19 pandemic led to record industry revenues.

Index providers generated positive growth in 2020, displaying agility and adaptability to meet the demands of a rapidly changing marketplace. As droves of investors entered the marketplace index providers adapted offerings to attract new entrants, with thematic and ESG indexes growing at the fastest pace in 2020.

Index revenues reached $4.08 billion, increasing 9.7% and bringing five-year CAGR to 11.0%. Index providers capitalized on sharp upticks in equity trading volumes, much of that influx pouring into ETFs. Global ETF assets continued rapid growth in 2020, with total year end assets in ETFs reaching $7.7 trillion, shattering a record set the previous year.

Data accessibility issues continue to plague smaller providers, as quality data continues to increase in price. Exchange data costs have grown at a rapid rate in past years, a trend currently being assessed by the SEC, who announced regulation on the matter late 2020. The scarcity of certain data sets also presents opportunities for data providers to leverage their own in-house data infrastructure, a trend seen most prevalently in fixed income indexing.

M&A continues to mold the industry, with two of the three largest index providers announcing landmark deals that could change the makeup of the industry. Index providers are disproportionately targeting data providers with the goal of leveraging new and more complete datasets into robust indexes that set them apart from the field

Asset-based fees continue to be the cornerstone of index vendor revenues, accounting for 49.5% of total index revenues. Providers continue to capitalize on shifts towards passive investing through expanded offerings. Subscription revenue is also achieving steady growth, though overshadowed in year-over-year growth.

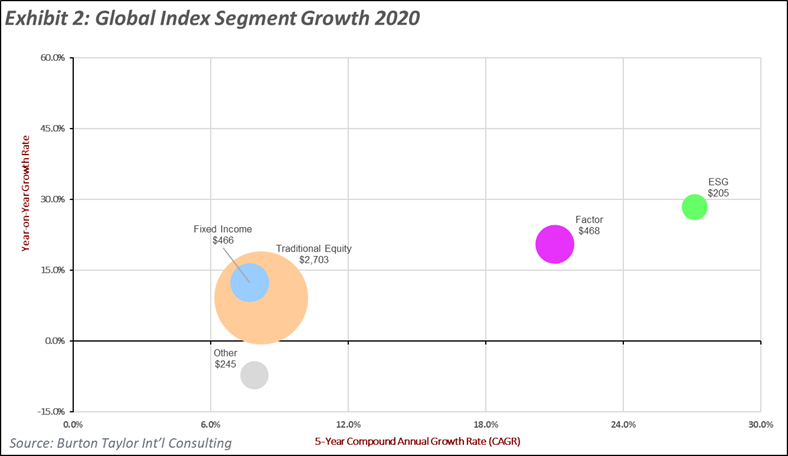

ESG offerings continue to expand as investors look to gain exposure to this rapidly expanding segment. The ESG segment grew the fastest of any in our study, with smaller index providers look to leverage rapidly growing demand to gain market share. A massive premium has been placed on reliable ESG data with many providers expanding their own data offerings or acquiring existing ESG data providers.

Factor indices are also seeing sharp upticks in popularity as investors look to gain access to more specific segments of the market to achieve higher returns. The growing factor index landscape aids in giving investors a more accurate look into more diverse corners of the market, providing more transparency in previously opaque markets.

2020 showed resilience among index providers, with most achieving record revenues amid a global pandemic. Data continues to be at a premium as index providers aim to expand offerings to provide transparency in an ever-changing marketplace. Adaptability to these constant changes will likely differentiate index providers who achieve success moving forward and those who are left behind.

Sean Eskildsen is an analyst with Burton-Taylor International Consulting. Visit our newly redesigned website at https://burton-taylor.com/ and see Burton-Taylor’s 2021 benchmark report on the index industry at https://burton-taylor.com/indexreport-2021/ and look for our continuing research for market data, exchanges and indexes, to be published throughout the year.